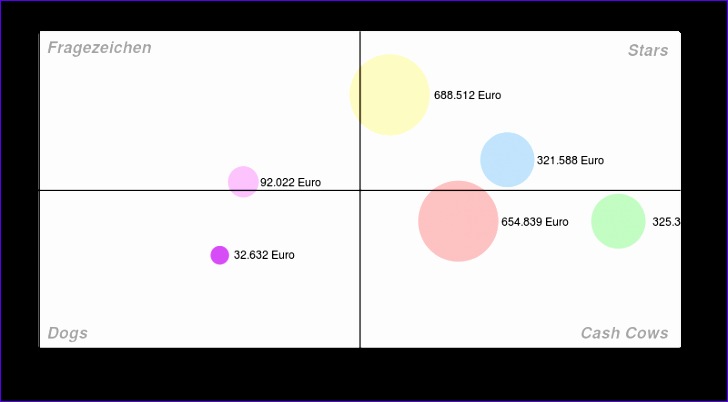

It is important not to just focus on the current PCM’s but also on the possible future PCM’s. The matrix can serve as the basis for a discussion about strategic decisions.īoth the GE McKinsey Matrix and the MABA matrix provide good projections about an organization’s future developments. The higher the volume in turnover of a PMC, the larger the circle. Draw the matrix and plot market attractiveness on the x-axis and competitive power on the y-axis.By comparing the final scores for market attractiveness and competitive power with the maximum score, it is possible to determine their position on the matrix. Have this done by several people within and outside of the organization. Define the aspects that determine the competitive power of the organizations.Market attractiveness is a critical factor that has to be considered carefully. Certain weight factors can be assigned to certain aspects. Define the aspects that determine the attractiveness of the market.Who are the customers of an organization and what are its products and/or services? Define the Product Market Combinations (PMC’s).This analysis is characterized by seven steps that must be followed: Based on these weights, the scores for competitiveness and market attractiveness can be calculated more accurately for each business unit. By assigning a weight to each factor, the GE McKinsey Matrix can be used more effectively. No extra investments but mainly focusing on maximizing returns. Holdīy making careful investments, the current market is consolidated. Growth is facilitated by expanding the market or making investments. Three different strategies can be distinguished and adopted using the this matrix: Invest / grow Instead of the four cells that are created in the BCG Matrix, this matrix creates nine cells.In addition to market share this matrix also considers the strength of a business unit.The McKinsey Matrix does not only consider growth, it mainly considers market attractiveness.This matrix bears a strong resemblance to the BCG Matrix. Access to internal and external finance resources.Other factors are used to determine competitiveness: Threats and opportunities (component of SWOT Analysis).Historical and expected market growth rate.This can be done by using the following factors:

It is possible to determine in advance whether a market is attractive enough to enter. Figure 1 – The GE McKinsey Matrix Factors

0 kommentar(er)

0 kommentar(er)